What’s the unique selling point of a Swiss Army knife? It’s the versatility it provides so that you don’t have to carry multiple tools – and that’s exactly what FlexFund is for inspection payments, a flexible option that caters to both inspectors and their clients’ needs. In this blog, we’ll cover the five primary ways FlexFund is an inspector’s versatile payment solution.

1. When clients are ‘price shoppers’

The home-buying process is costly, and clients are likely watching their funds closer than ever. With their new home budget already established, some clients may not know the fees involved with inspections. So, if a potential client is evaluating inspectors based on total cost, FlexFund can be a great value-add for inspectors who offer the payment option due to its flexibility.

Why not attract price shoppers with a payment option that allows them to pay at closing instead of upfront? It’s a smart decision and one that could pay off many times over. Just make sure that when adding FlexFund to your tool belt (so to speak), it’s easy to find and well-known in your marketing materials, and a talking point when speaking to potential clients on the phone.

2. Packaging inspection services

Mold detection, radon testing, asbestos, roof, sewer scope—there’s no telling what clients will request during an inspection. Some will want a select combination of your services, and in some cases, all of them. Maybe inspectors only want to offer FlexFund when mold detection and sewer scope are requested. Yet another inspector may want to customize FlexFund only for the chimney and roof. There are too many combinations to count, but that’s the beauty of FlexFund—it’s flexible!

Packaging services together is great way for inspectors to sell their services, because they can provide discounts and leverage FlexFund as a benefit of those packages.

3. Certain inspection types

Don’t want to package services together, and only want to present FlexFund on specific inspection types? No problem, as inspectors can hand-pick the types of inspections for which they wish to make FlexFund available in their ISN settings.

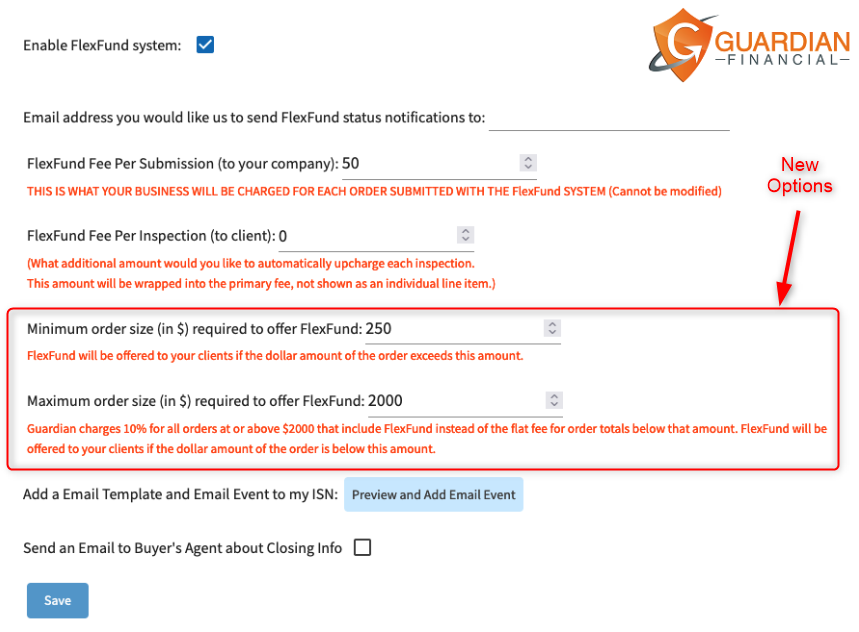

4. Matching pre-set minimums and maximums

Here, inspectors have better control over FlexFund usage and associated fees by setting their designated transaction amounts and when to automatically offer the payment option. Simply set the minimum and maximum amounts once and it’s done! Automation takes care of the rest – your online scheduler and/or order form will update whenever you save changes to these settings.

It’s easy to customize your transaction totals in ISN by following this click path: Settings > Office Settings > FlexFund Options:

5. Inspection-by-inspection basis

The situations above are all valid options, but maybe an inspector doesn’t want to automatically apply FlexFund to ANY situation. That’s fine too, as they can provide the option at their discretion in a more “manual” approach.

Add more flexibility to your payment processing arsenal

Think of FlexFund as your “ace in the hole” to book more appointments. With many use cases and built-in flexibility, FlexFund is the epitome of having options when it comes to payments (it’s in the name, after all!). It’s a win-win for inspectors and clients alike, and could be the deciding factor in winning more business. Learn more and get started here.