The housing market this summer is showing some mixed signals. June’s numbers reveal a market that’s stable—but not without a few stress points. While home sales barely budged in June, prices continue to climb in several regions, and experts are dialing back their forecasts for the rest of 2025.

The good news? Inventory is still holding strong, and early projections for 2026 are looking a lot brighter. If mortgage rates dip—even just a little—inspectors could see a surge in fall activity. It’s a trend worth tracking as we move toward year-end.

By the Numbers: June 2025 Trends

- Existing home sales: 391,000 in June, just a nudge above May (+0.3% month-over-month) and up +4.0% compared to last year. For the year so far, sales are down slightly at -1.5%.

- Inventory: 1.53 million homes on the market—just off the May high, but a strong +15.9% jump year-over-year.

- According to HouseCanary: Inventory shot up +23.1% YoY, contract volume increased +7.3%, and closed prices rose +2.8%. However, price reductions were up a significant +32.3%.

- Median price: Nationally, the median price for an existing home ticked up to $435,300, a +2.0% YoY increase. The Midwest (+3.4%) and Northeast (+4.2%) are leading on price growth.

- Mortgage rates: Averaged 6.8% in June, with many predicting a slight drop to around 6.7% by the end of the year.

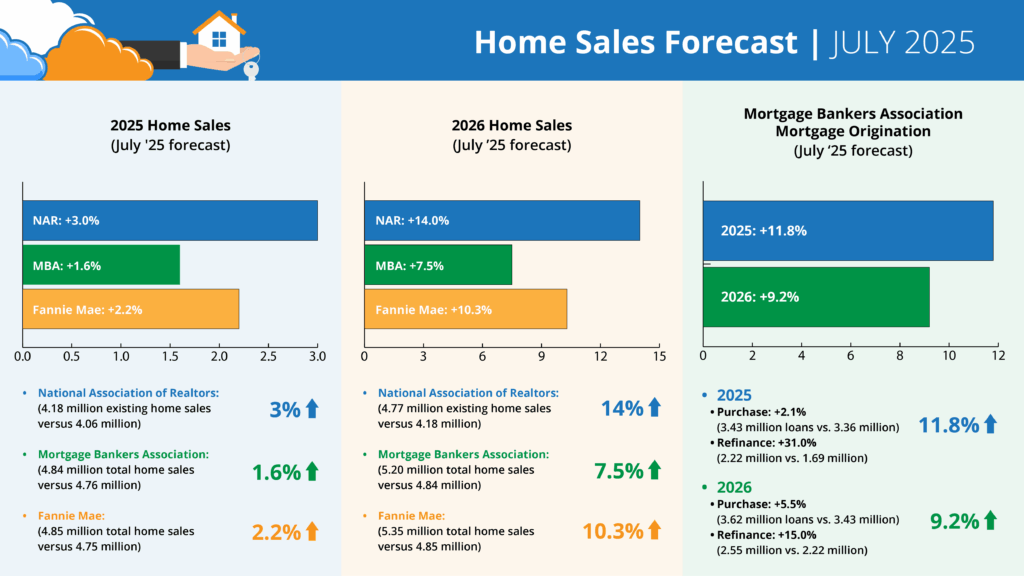

2025–2026: What’s Ahead?

The National Association of Realtors (NAR) just released an updated forecast:

- 2025: NAR now expects existing home sales to grow by 3% (down from 6% earlier this year).

- 2026: Optimism returns, with a +14% increase forecasted.

- The average 2025 forecast from NAR, MBA, and Fannie Mae now sits at +2.3% YoY—less rosy than the +6.8% outlook at the start of the year.

Home Sale Projections

2025 Forecasts (July 2025):

- NAR: +3.0% (4.18M sales)

- MBA: +1.6% (4.84M sales)

- Fannie Mae: +2.2% (4.85M sales)

2026 Forecasts:

- NAR: +14.0% (4.77M sales)

- MBA: +7.5% (5.20M sales)

- Fannie Mae: +10.3% (5.35M sales)

Mortgage Originations (MBA, July 2025):

- 2025: +11.8% (5.65M loans); Purchase up +2.1%, Refi up +31.0%

- 2026: +9.2% (6.17M loans); Purchase up +5.5%, Refi up +15.0%

What Does This Mean for Inspectors?

For home inspectors, especially those using Guardian Inspection Payments, this is the time to double down on efficiency. The market might be steady for now, but a pickup in activity is possible this fall—and you’ll want to be ready.

Here’s how you can stay ahead:

- Get organized now: Streamline your payment processes and appointment scheduling so you can handle a busier season without missing a beat.

- Automate reminders and payments: Take advantage of Guardian’s features to make your back office run on autopilot.

- Stay flexible by offering multiple payment methods: Be prepared to accept payment from your clients in a variety of ways.

Bottom line? The market may be in a bit of a holding pattern, but smart inspectors are prepping now to make the most of what’s ahead. With the right systems in place, you’ll be ready for whatever comes next.