There are many ways to ‘win’ a new client, but payment terms can sometimes be overlooked. With many acceptable payment options—cash, card, check, PayPal, Venmo, Zelle—they all have pros and cons. But today, we’ll explore why Guardian Inspection Payments, and specifically FlexFund, is a great option that large inspection businesses should consider offering.

Guardian offers the lowest rates

Compared to other industries, the inspection industry isn’t particularly huge. Suppose an inspection company wants to negotiate credit card processing rates with their bank. Here, the inspector doesn’t have much leverage because their business might be considered small (or medium), even if it’s a large inspection business. Banks prioritize working with companies doing tens of millions in transactions, and might not give those inspection companies the special treatment they’re looking for.

Here’s the key difference: Guardian is dedicated to the home inspection industry, so every account is big! Not only that, but we’ll negotiate with inspection businesses of all sizes.

Guardian’s rates are already the lowest in the industry, but we’ll always work with high-volume inspection businesses to ensure they feel valued. At the end of the day, if you can find a better rate that we cannot match or beat, we’ll pay you $500. Would you really turn down the chance at $500?!

FlexFund drives more real estate agent referrals

No matter how big an inspection business is, all inspectors love agent referrals. Getting a phone call, text, or email from an agent about their client’s inspection needs cuts down on the inspector’s need to do marketing. Of course, it could lead to new referrals once the report is complete as well.

Inspection businesses offering FlexFund help increase demand by attracting new agents that will send referrals because an inspector offers flexible payment options to clients. Think about it—when agents have clients needing inspections, are they more likely to refer inspectors who will accommodate the buyer or one who is more rigid with payment terms? Agents see the value in FlexFund and will likely remember those inspectors who cater to clients in a variety of ways.

Clients appreciate the flexibility that FlexFund offers

The home buying process is already stressful for clients, but FlexFund is a free service for them that helps provide financial planning flexibility and reduces stress during a pending close. It’s designed to give them extra peace of mind by enabling them to pay for inspections at closing instead of at the time of service. Inspectors still get paid upfront (even if the deal falls through)!

With FlexFund, clients have the option to pay for the inspection at closing, so it’s great for homebuyers who are:

- Limited in terms of cash on-hand

- Anxious about adding ancillary services to their home inspection in the interest of limiting spending prior to closing

- Hesitant about putting large purchases on a credit card while the close is pending

Paying at closing helps to ensure a more comfortable home buying experience because the buyer doesn’t need to swipe a credit card or have significant funds available in their checking account. Additional inspection services like radon, mold detection, and sewer scope can all be scheduled for payment on a set date.

Top-tier customer service

Guardian representatives are available to connect 1:1 with you at any time, because we know that issues or questions regarding payment are of the highest importance. Whether it’s helping you get your payment processing application across the finish line, answering questions about how FlexFund works, or talking through specific questions or concerns about individual transactions, Guardian will always answer your call.

Contact information for general Guardian inquiries can be found here, while contact information for FlexFund-related inquiries can be found here.

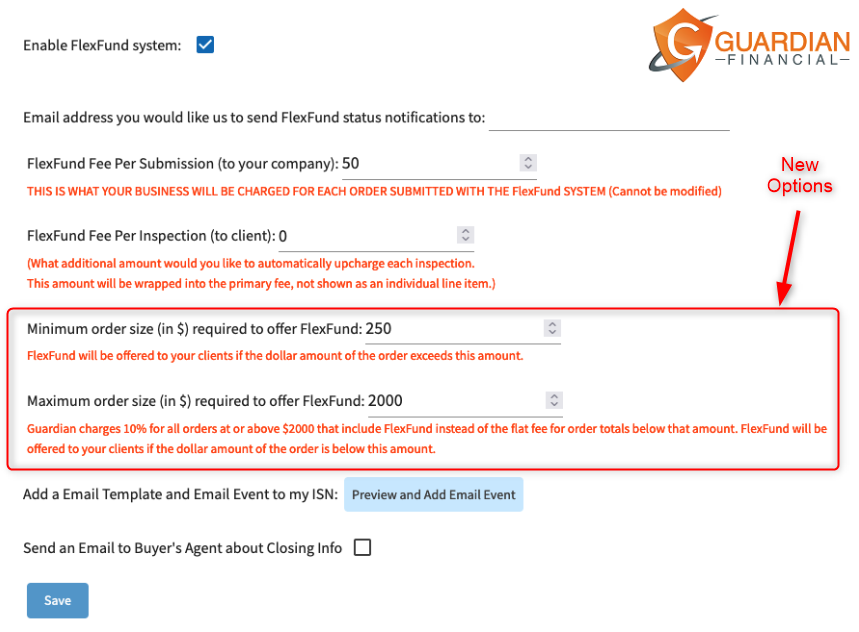

Bonus! Customize transaction amounts with FlexFund

FlexFund gives inspectors more control over usage and associated fees! Now, inspectors can customize when to offer FlexFund using minimum and maximum transaction totals:

Consider adding FlexFund for client payments

FlexFund continues to be a great option for inspectors to win new business in a variety of ways. It is a strong value-add because you’ll always get paid upfront, it allows you to customize precisely when it becomes an option for your clients, and your clients will appreciate the payment flexibility. Learn more about FlexFund here to get started. Your clients and bottom line will both thank you!